No Tax on Interest

No Tax on Dividends

No Tax on Capital Gains

A quick heads-up:

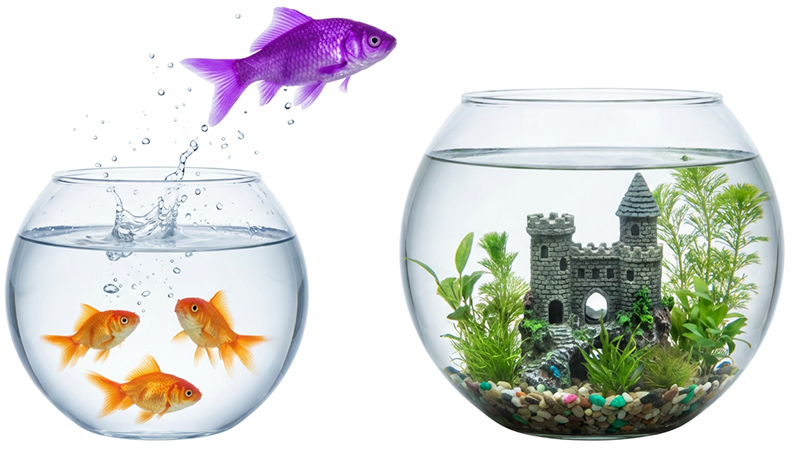

If you withdraw, you don’t get that contribution space back — so a TFSA works best for goals you can commit to, without dipping in and out.

One of the Smartest Ways To Invest for Your Future.

Whether you’re growing long-term wealth, saving for retirement, or putting money away for your kids, a Tax Free Savings Account (TFSA) lets you invest without paying tax on your returns.

No Tax on Interest

No Tax on Dividends

No Tax on Capital Gains

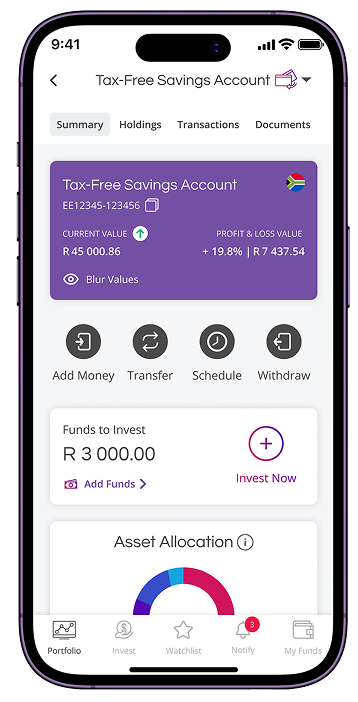

Why Have a TFSA With EasyEquities?

Zero Tax. Zero Catches.

You pay no tax on dividends, capital gains, or interest earned. For life. It’s that easy.

Low Fees = More for You.

Our low-cost platform keeps more of your money invested and working hard.

More Investment Choice.

Choose from approved JSE-listed ETFs (including Actively Managed ETFs), SA Government Bonds, unit trusts, and expert-managed Bundles.

Easy to Start, Easy to Manage.

A TFSA comes standard with your EasyEquities account. All you need to do is fund it and start investing.

How Does a TFSA Work?

Invest up to R36,000 per year (and R500,000 over your lifetime).

All returns inside your TFSA are completely tax-free.

You can withdraw anytime but withdrawals don’t reset your limit.

The earlier you start, the longer your money has to grow, tax-free.

Start Your Tax Free Journey Today

Whether you're investing for the first time or growing a global portfolio, EasyEquities makes it easy.

Create Your Account Today

Frequently Asked Questions

What is a Tax-Free Savings Account (TFSA)?

A TFSA is an investment account that lets your money grow completely tax-free — meaning you pay no tax on interest, dividends, or capital gains you earn.

How much can I invest in my TFSA?

You can invest up to R36,000 per tax year, with a lifetime contribution limit of R500,000 across all TFSA accounts — not just one provider.

What can I invest in with an EasyEquities TFSA?

With a TFSA on EasyEquities, you can invest in ETFs, SA Government Bonds, and other approved investments that give you instant diversification. Individual shares aren’t allowed in a TFSA.

Can I withdraw money from my TFSA at any time?

Yes. You can withdraw your money whenever you need to. Just remember — any amount you withdraw can’t be replaced, and still counts toward your lifetime TFSA limit.

What happens if I invest more than the allowed limit?

TFSA limits are set by SARS, and exceeding them can result in a 40% tax penalty on the excess amount.

The good news? EasyEquities’ intuitive platform helps prevent you from investing more than your allowed TFSA limit, so you don’t have to stress about accidentally over-contributing. Just keep in mind that if you have TFSAs with other providers, those contributions still count toward your total limit.